Enhanced Authentication

Effortlessly access your account with Face ID or Fingerprint, anytime, anywhere.

From real-time financial insights to streamlined transactions and effortless account management, this all-in-one solution is designed to help you take control of your business finances with ease.

Explore a world of convenience with our Multiple Payment Options. Fit your transactions to your needs, ensuring seamless and efficient financial management with every interaction.

Effortlessly access your account with Face ID or Fingerprint, anytime, anywhere.

Filter transactions by date over any required period to gain detailed insights of financial activities

Manage multiple accounts with a single login, and easily nickname accounts for quick access.

Schedule one-time or recurring payments, and authenticate third-party payments securely.

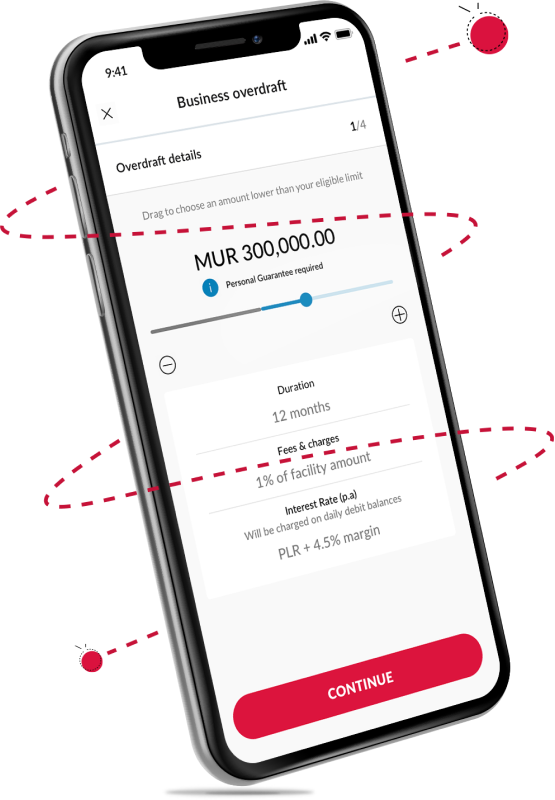

In just a few taps, apply and obtain for an Express Overdraft of up to MUR 1m within a minimum of 24 hours.

Quickly retrieve and download your Proof of Payment for all completed transactions on the Payments dashboard

Hide or unhide accounts to control over what you see at any moment.

Speed up transactions by displaying favourite accounts and managing them with personalised nicknames.

Enjoy smooth, easy navigation to quickly manage your banking needs.

Streamline your scan-to-pay process and easily manage your cards with the new Quick Links feature for seamless access and control

Download

Express your interest below or send us any questions you have. We're here to help you navigate your options and get started on your journey with us!

1. Who is eligible for MCB JuicePro?

MCB JuicePro is available to MCB Micro Enterprises, Small Businesses, Medium businesses and Mid-Market Enterprises, specifically to customers who are designated as signatories of their company(ies). Users must also possess a valid Business Registration Number (BRN) among other eligibility criteria.

2. Is MCB JuicePro available on both iPhone and Android devices?

MCB JuicePro is compatible with iOS 15 and above for iPhone users; and Android 6 and above for Android users.

3. How do I register with MCB JuicePro?

You can download the MCB JuicePro app from your preferred app store and complete the intuitive onboarding process. Registration involves providing your personal details, including the number of a valid MCB card (debit, business debit, credit in either local or foreign currency).

During the registration process, you will also be required to provide a unique email address and mobile number which shall become your login credentials for both MCB JuicePro and MCB Internet Banking Pro.

4. Can more than one company be registered on MCB JuicePro?

Once you have logged into MCB JuicePro, you will be able to see all the companies you have access to. From there, you can easily select the specific company you need for your transaction.

5. Can MCB JuicePro be installed on more than one device?

Yes, you can install MCB JuicePro on multiple devices. However, MCB JuicePro can only be active on one device at a time.

6. Does MCB JuicePro and MCB Internet Banking Pro uses the same credentials to login?

Yes. You may log in onto both platforms (MCB JuicePro and MCB IB Pro) using the same credentials. If you are already a user of MCB IB Pro, just download MCB JuicePro from app stores and use your MCB IB Pro credentials to log in instantly to our mobile banking app.

Additionally, if you have registered to MCB JuicePro and not yet to MCB IB Pro, you only need to log onto the MCB Internet Banking Pro platform using these credentials (email or mobile number) and password created during the registration process in MCB JuicePro.

7. What can I do on MCB JuicePro?

MCB JuicePro offers a range of features that have been designed to simplify your daily banking transactions and save you time. To explore the latest functionalities and how they can benefit your business, please visit our dedicated webpage for MCB JuicePro.

8. Is there a service fee associated to MCB JuicePro?

MCB JuicePro is completely free, providing a variety of online features and services at no cost. However, please be aware that standard banking services that typically incur fees, will still be subject to those charges, as well as certain specific digital features. You may view our applicable fees and charges here.

9. What should I do if my MCB JuicePro is not working?

You should first check if your Wi-Fi or mobile data is enabled, and then try launching your MCB JuicePro app again. If the problem persists, please call the MCB Contact Centre on 202 6060.

10. What should I do if my transaction is unsuccessful or pending?

If your transaction is unsuccessful or pending, please reach out to your account officer or contact center for assistance. If a transaction is waiting for approval from another signatory, all signatories will receive a notification to approve it. You’ll also be notified if the transaction is approved or rejected. Lastly, you can check the live status of all your payment transactions in the “Payment” menu of the app.

11. What should I do if I forget my mPIN?

Go to 'Forgot mPIN' from the login screen and tap "OK". MCB JuicePro will reset, and you will be able to access the steps to create a new mPIN.

12. What are the security measures in place for the app?

MCB JuicePro uses a multifactor authentication system to ensure that only you have access to your app. Additionally, every transaction requires the use of your MPIN or biometric authentication (if enabled) for authorisation.

13. What do I do if I lose my mobile phone?

If your mobile phone is lost or stolen, you should immediately report it by calling our Contact Centre on 2026060 to prevent unauthorised transactions.

14. Is it possible to authorise all transactions on MCB JuicePro using biometrics?

Yes. Once you have enabled the use of biometrics on your phone, you can use them to authorise transactions instead of using the basic mPIN method. iOS users can resort to both fingerprints and face ID to authenticate any transaction. For Android users, we are only able to recognise fingerprints at the moment.

15. Is OTP still in use in MCB JuicePro?

Yes. When you perform a Self-Registration or a Device Registration, you will receive an OTP (one-time password) by SMS for authentication purposes.

16. What are the limits for transfers and payments?

There’s no limit for transfers and payments in MCB JuicePro. However, limits will apply as per the instructions provided by your company’s Board of Resolution.

17. Can I view and download my statements and advices from the app?

Yes, you can download your statements and advices from MCB JuicePro which is directly available for each of your accounts. You will need to use the filter option to show your statements & advices.

18. Can I take a screenshot of the app?

No. As a security measure to prevent the disclosure of any customer information, you will not be able to take screenshots within the app.

19. How is my account(s) balance(s) displayed on the Dashboard menu?

Your total balance will be displayed on the dashboard when you log in. If you have multiple accounts in different currencies, the total for each one will be shown.

We're available 24/7 to assist with any queries.